Content

The table below lists the https://www.bookstime.com/ limits for individuals under 65 years old. Keep in mind that older taxpayers tend to have higher thresholds, and the threshold changes if neither, one, or both individuals in a marriage are 65 or older. The form uses what the IRS terms a building block approach and allows taxpayers to add only the schedules they need to their tax returns. Everyone who earns income over a certain threshold must file an income tax return with the IRS. Keep in mind that businesses have different forms to report their profits.

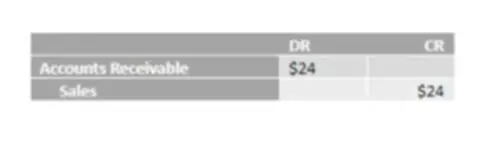

A simple tax return is one that’s filed using IRS Form 1040 only, without having to attach any forms or schedules. Can claim any credit that you didn’t claim on Form 1040 or 1040-SR, such as the foreign tax credit, education credits, general business credit. Have other payments, such as an amount paid with a request for an extension to file or excess social security tax withheld. Form 1040 is used by U.S. taxpayers to file an annual income tax return.

🤔 Understanding Form 1040

Provide your bank details to be used for direct deposit into your account if you receive any refund. The IRS changes and updates its forms regularly, so it’s best to check the IRS website for the 1040 form 2022. If the taxes you paid are less than the taxes owed , you will need to pay money to the IRS. If you want to calculate the amount you owe, simply subtract line 19 from line 16. As a self-employed person or freelancer, you are required by the IRS to pay self-employment tax.

That What is a 1040 Form preparer should find and fill out the 1040 form on your behalf, and then electronically file it with the IRS. You can see the instructions of Form 1040 by clicking on/pub/irs-pdf/i1040gi.pdf. That is not a problem, you can have your refund mailed as a check to your home address. You will always have the option to have your check mailed to your house regardless of if you are filing electronically or sending your return by mail.

Credits & Deductions

She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. Another change to Form 1040 that showed up in 2020 is that there are three lines to report withholdings. On Form 1040, Line 25a is for W-2 withholdings, Line 25b is for 1099 withholdings, and Line 25c is for other withholdings. Here’s a guide to all of the 1040 variations you may come across.

Pay it online to avoid mailing the form in the mail. The IRS offers resources on where, when, and how employers can file W-2 forms for employees. There are a handful of other taxes that will require you to also complete Schedule 2. On the first page of Form 1040, you’ll provide your name, Social Security number, address, and information on your dependents. Form 1040-V, also called a “Payment Voucher,” in order to do so. Most people choose to pay their tax bills online for ease of convenience. Many or all of the products featured here are from our partners who compensate us.

Changes to complexity and tax rates

It reduced the number of lines from 79 to 23, removed two of the variants in favor of the redesigned Form 1040, and redesigned the supplemental schedules. Just over 350,000 forms were filed in 1914 and all were audited. Form 1040-NR is used by taxpayers who are considered “non-resident aliens” for tax purposes. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. Pathward does not charge a fee for this service; please see your bank for details on its fees. See Online and Mobile Banking Agreement for details.

- But for business owners, independent contractors, and the self-employed, there are some specific details you should know about.

- The table below lists the income limits for individuals under 65 years old.

- With the Current Tax Payment Act of 1943, income tax withholding was introduced.

- Is a deposit that a buyer puts down as a deposit to the seller at the time of entering into a contract for a large purchase, often used in the sale of a house.

- Robinhood Crypto, LLC provides crypto currency trading.

- If one has not done so, then a tax penalty may be assessed.

This includes nonresident aliens plus students on a J-1 or F-1 status. Whether you can use the 1040-NR or switch to the 1040 depends largely on the substantial presence test. If you requested Form 1099 from a business or agency and didn’t receive it, contact the IRS. Wait times to speak with a representative may be long.